AI Products

Customer-facing

Employee-facing

Who We Help

Employee-facing

Platform

Trust & Security

Copyright ©0000 Posh AI. All Rights Reserved.

The Associated Credit Union of Texas ($523 million AUM) serves more than 43,000 members in more than 20 counties in Texas. Their mission is to offer progressive, quality financial services responsive to the member-owners. The credit union is dedicated to providing these services in a caring, professional manner while maintaining a strong financial base.

ACU of Texas desired to have more in-depth conversations with their members to assist in making sound financial decisions and attain their financial goals. Still, the high volume of incoming calls regarding simple self-service inquiries, like routing numbers and account balances, was consuming much of their call center resources. It became necessary to find a solution to reduce this call volume and enable ACU of Texas to focus on providing more personalized and meaningful support to their members.

"We wanted to allow our agents to have a better, in-depth conversation with our members and really improve the overall member experience here at Associated [Credit Union of TX]," said Mike Procenko, Member Experience Center Manager (Contact Center).

Posh became ACU of Texas's partner for the purpose-built conversational AI platform, launching Posh's full suite of capabilities, including Digital Assistant within web, online and mobile channels, as well as Voice Assistant – assisting members across all channels. ACU of Texas collaborated with Posh to create a comprehensive AI-powered member experience that promotes self-service and enhances member experiences. This included working with Posh's Client Success team and leveraging resources such as the industry's most extensive set of out-of-the-box intents and a content designer to create a unique ACU of Texas experience.

"It made things a lot easier; you can't think of every scenario or intent that pops up. It made it much easier to agree that we needed that, and having the ability to program our own intents is extremely user-friendly," Procenko said of the low-code Posh Portal.

The credit union debuted Associated's Virtual Assistant or Ava, which members were introduced to with a landing page to explain how to best utilize AVA.

"We kind of tongue in cheek say that Ava is our newest employee for the contact center. And I absolutely, 100% would recommend anybody who is thinking about adding AI to definitely do it" said Procenko.

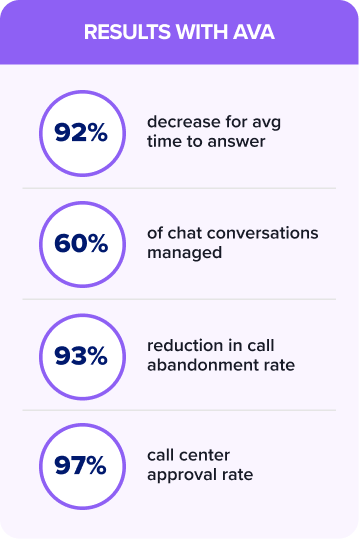

Within two weeks Ava:

"[Ava] allows the agents to focus on the members with more in-depth questions," Mike said. "The response to the feedback survey we've added is overwhelmingly positive."

Driving customer success from the start to beyond the finish line: Our client success team strives to deliver Helpful Banking Moments and embeds a Partner for Life clause with every Posh agreement. Posh's client success team collaborates with clients to customize their AI chat experience based on their organization's culture and KPIs, ensuring immediate value upon AI's launch.

Optimizing and configuring AI on an ongoing basis is essential to improve its performance and tailor it to the unique requirements of each client while also leveraging the advancements in technology. As a company specializing exclusively in AI for banking, we invest in the domain expertise needed to achieve long-term success. With Posh's Partner-for-Life program, we arrange biannual meetings with our clients to guarantee their AI performance is optimized.

"We do have some partners or some vendors that we use that if I've got a question for them and I reach out, their answer is, "Oh, here's the link to our online database. Good luck." As a user, if I told my members that, I wouldn't have any members left," said Mike Procenko.

Whether partners choose the full suite or a singular product, they'll receive the same level of care, service, and partnership from Posh. Conversational AI isn't the future; it's current and is offering a pathway to dynamic, empathy-leading member service.

"[Conversational AI] is very helpful. We kind of tongue in cheek say that Ava is our newest employee for the contact center. And I absolutely, 100% would recommend anybody who is thinking about adding AI to definitely do it" said Mike Procenko.